The Capital One Savor Cash Rewards Credit Card is no longer taking new applicants as of July 2024, although existing cardholders can still use the card. Those interested in the Capital One Savor Cash Rewards Credit Card can check out Capital One SavorOne Cash Rewards Credit Card instead.

If you’re a big baseball fan looking for an easy way to score discounted MLB gear and tickets, as well as a chance to win tickets to the 2024 World Series, your Capital One credit card can help.

As part of Capital One’s partnership with the MLB, cardholders can redeem Capital One rewards toward tickets from all 30 MLB teams, as well as for tickets to select MiLB games. As a cardholder, you also get exclusive discounts on MLB merchandise, streaming subscriptions as well as other baseball experiences.

With the World Series fast approaching, here’s everything you need to know to make the most of your Capital One card and MLB perks.

MLB benefits offered by the Capital One partnership

Your Capital One card unlocks various MLB perks, including game tickets, VIP experiences, merchandise discounts, baseball museum discounts and more.

2024 World Series Sweepstakes

Eligible cardholders can enter the Capital One’s World Series Sweepstakes for the chance to win the following grand prize:

- 2 tickets to one World Series™ Game

- 2 passes to the batting practice pregame

- A $2,000 travel and accommodations stipend

- A $250 MLBShop.com gift card

The sweepstakes is accepting entries until September 29, 2024, and there is a limit of only one entry per person.

MLB tickets and experiences

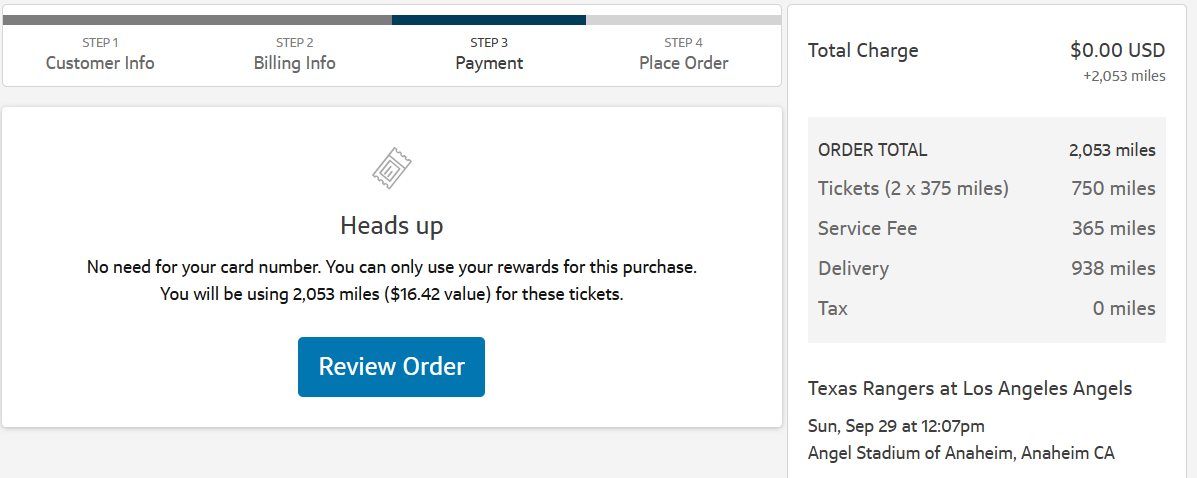

You can also access MLB tickets through Capital One Entertainment. You can purchase tickets via Capital One or redeem rewards toward tickets to any of the MLB or select MiLB games available. After selecting a team, you are able to:

- Filter results by home games, away games, locations and dates

- View a map of the baseball stadium’s seating

- See how much rewards cash is needed to cover each ticket

- Book tickets with your card, rewards, your card, or a combination of both

As you might expect, lower- and mid-level seating, especially close to home plate or the dugout, will require more rewards than outfield seating.

EXPAND

Note also that for some games, you can only book tickets with your rewards — not your card.

EXPAND

Cardholders may also have access to VIP experiences, such as batting practices, on-field sessions and more.

MLB.TV

Cardholders get a 30 percent discount on an MLB.TV yearly subscription, which gives you access to various MLB and MiLB game streams, as well as local pregame and postgame showings live or on demand. You can also access the MLB.TV app’s pitch-by-pitch Watch Hub and check out shows like Big Inning, Baseball Zen, Carded and Inside Stitch.

Your subscription discount is applied automatically when you use your unique Capital One cardholder MLB.TV offer code. Currently, the regular all-teams MLB.TV subscription is listed for $29.99 per year, so with your discount, you’d only pay $20.99.

EXPAND

There is also a new $6.99 monthly subscription that gives U.S. subscribers access MLB network content and MLB’s At Bat features.

The key difference between the two subscriptions is that the All Teams yearly subscription gives you access to every out-of-market game live or on demand, while the monthly MLB Network + At Bat subscription only offers access to select out-of-market games and live audio.

MLB Shop discounts

With an eligible Capital One credit card, you can get a 20 percent discount on your MLBShop.com order by using the code CAPITALONE at checkout (though some terms apply).

The shop has authentic jerseys, caps, apparel and collectibles and allows you to shop by team, player or clothing department. You can also customize your favorite team’s jersey by adding your own name and number.

Jackie Robinson Museum discount

Capital One cardholders also get a 20 percent discount on entry to the Jackie Robinson Museum in New York City. You can visit JackieRobinsonMuseum.org and enter the code CAPITALONE when purchasing tickets (terms apply).

The museum houses a number of exhibits and memorabilia and hosts events about Jackie Robinson’s legacy and his influence on baseball and civil rights.

MLB Mondays at the Capital One Café

Even without a Capital One card, you can get a pass for a 12-ounce free drip coffee or hot tea every Monday during the 2024 MLB season until the end of the World Series.

Top Capital One rewards cards for MLB tickets

If your Capital One card earns rewards, you can still redeem toward tickets for the current MLB season or use your card’s discounts to get geared up for the 2024 World Series presented by Capital One, with the first game set for Friday, Oct. 25, 2024.

Here are some of the top Capital One cards you can use toward ticket redemptions:

-

Capital One Savor Cash Rewards Credit Card*

- Rewards: 4 percent cash back on dining, entertainment and popular streaming services, 3 percent cash back at grocery stores (excluding superstores like Walmart and Target) and 1 percent cash back on all other purchases.

- APR: 19.99 percent to 29.99 percent (variable)

- Additional cardholder perks: No foreign transaction fee, travel accident insurance, basic security features and access to concierge service and Capital One Shopping, Dining and Entertainment.

Capital One SavorOne Cash Rewards Credit Card

- Rewards: 10 percent cash back on purchases made through Uber and Uber Eats (through Nov. 14, 2024), 8 percent cash back on Capital One Entertainment purchases, unlimited 3 percent cash back on dining, popular streaming subscriptions, entertainment and grocery store purchases (excluding superstores like Walmart and Target), 5 percent cash back on hotels and rental cars booked using Capital One Travel and 1 percent cash back on all other purchases.

- APR: 19.99 percent to 29.99 percent (variable)

- Additional cardholder perks: No foreign transaction fee, price protection, extended warranty, basic security features, access to concierge service and Capital One Shopping, Dining and Entertainment.

Capital One student rewards cards

Capital One SavorOne Student Cash Rewards Credit Card

- Rewards: Unlimited 3 percent cash back on dining, popular streaming services, entertainment and at grocery stores (excluding superstores like Walmart and Target), 8 percent cash back on Capital One Entertainment purchases, 5 percent cash back on hotels and rental cars booked through Capital One Travel, 10 percent cash back on purchases made through Uber and Uber Eats (through Nov. 14, 2024); 1 percent cash back on all other purchases.

- APR: 19.99 percent to 29.99 percent (variable)

- Additional cardholder perks: No foreign transaction fee, price protection, extended warranty, basic security features, automatic account review for potential credit line increase, access to concierge service and Capital One Shopping, Dining and Entertainment.

-

Capital One Venture Rewards Credit Card

- Rewards: 5X miles per dollar on hotels and rental cars booked through Capital One Travel and 2X miles per dollar on all other purchases.

- APR: 19.99 percent to 29.99 percent (variable)

- Additional cardholder perks: No foreign transaction fee, travel benefits such as airport lounge access, $100 credit toward TSA PreCheck and Global Entry, lost luggage reimbursement and auto rental collision insurance, access to Capital One Shopping, Dining and Entertainment.

Capital One VentureOne Rewards Credit Card

- Rewards: 5X miles on hotels and rental cars when you book through Capital One Travel and 1.25X miles on all purchases.

- APR: 19.99 percent to 29.99 percent (variable)

- Additional cardholder perks: No foreign transaction fee, access to Capital One Shopping, Dining and Entertainment.

Capital One Venture X Rewards Credit Card

- Rewards: 10X miles on hotel and rental cars booked through Capital One Travel, 5X miles on flights through Capital One Travel and 2X miles on all other purchases.

- APR: 19.99 percent to 29.99 percent (variable)

- Additional cardholder perks: Travel benefits such as airport lounge access, $100 credit toward TSA PreCheck and Global Entry, $100 travel credit, annual bonus miles, trip delay reimbursement, trip cancellation and interruption insurance and baggage delay reimbursement, return protection, cellphone protection, auto rental collision insurance, access to Capital One Shopping, Dining and Entertainment.

-

Capital One Spark Miles for Business

- Rewards: 5X miles on hotels and rental cars booked through Capital One Travel and unlimited 2X miles per dollar on all purchases.

- Annual fee: $0 the first year, $95 thereafter

- APR: 26.24 percent (variable)

- Additional cardholder perks: Travel assistant services, $100 credit toward TSA PreCheck and Global Entry, rental collision coverage, extended warranty, purchase protection, access to Capital One Shopping, Dining and Entertainment.

Bankrate experience: Here’s what our experts say

Bankrate credit cards writer and casual baseball fan Ryan Flanigan has experience using Capital One points to attend an MLB game. His advice: Act fast to get the best deals.

Capital One points are a great way to score cheap MLB tickets — if you can get them. The catch is that they are only released around a month or two in advance, so you won’t be able to plan very far ahead. Also, the best deals tend to get scooped up quickly, so you need to act fast. But it can totally be worth it. I recently paid just 4,000 points for lower-level seats and was able to plan a quick getaway to check a new stadium off my list.

— Ryan Flanigan, Writer, Credit Cards

How to maximize your Capital One card for MLB perks

Now that you know which Capital One card you want to use this season, make sure you follow these tips to get the most out of your MLB perks:

- Plan your MLB game bookings well in advance of the first pitch to be sure you’ll earn enough in rewards to cover tickets.

- Be sure to act fast when you see a good deal on game bookings via Capital One Entertainment — tickets go quickly.

- Take advantage of your Capital One card to purchase discounted MLBShop.com gear, MLB.TV subscriptions or Jackie Robinson Museum tickets.

The bottom line

Capital One’s partnership with MLB means cardholders get access to a wide range of valuable perks, from the ability to book tickets with rewards to heavy discounts on MLB gear and streaming packages. The key is to plan ahead when you can and act fast when you spot a good deal.

*Information about the Capital One Savor Cash Rewards Credit Card has been collected independently by Bankrate. Card details have not been reviewed or approved by the issuer.

For Capital One products listed on this page, some of the above benefits are provided by Visa® or Mastercard® and may vary by product. See the respective Guide to Benefits for details, as terms and exclusions apply.

Frequently asked questions (FAQs) about MLB perks through Capital One

-

Capital One Entertainment is a portal where cardholders can redeem their rewards in exchange for tickets to various events including concerts, dining, live sporting events, festivals and more.

-

Ticket costs vary depending on the seating and specific game you select. When redeeming cash back, you can get tickets for as little as $4 to $6 in rewards cash, but some seats and dates may run over $400 in rewards cash.

If you redeem miles, you can expect to get about 0.8 cents per mile in value for MLB tickets.

For exclusive premium seats, you can expect to redeem around $40 in cash rewards or 5,000 miles toward lower-level tickets.

-

Capital One Entertainment includes tickets to games for all 30 MLB teams, including regular season, postseason and World Series games.

-

Capital One’s Cardholder Exclusive MLB tickets are premium seats available at a discounted rate for cardholders. You can get lower-cost tickets that are farther away from the field, but regular tickets that are closer to the field will likely cost more without the Cardholder Exclusive deal.

-

Log into your Capital One account through the Capital One Entertainment portal, click “Access MLB tickets,” choose a team and look for any games with a blue “Cardholder Exclusive” label. Note that there are about four cardholder exclusive tickets available for each game, so you’ll need to act quickly to claim them.

Read the full article here