Nvidia released its earnings report on Wednesday and projected that fourth-quarter sales were above Wall Street estimates, but investors balked as those figures fell short of the lofty expectations the artificial intelligence (AI) giant has garnered during its historic rise.

Nvidia forecast fourth-quarter revenue of $37.5 billion, plus or minus 2%, compared to analysts’ average estimate of $37.09 billion, according to data compiled by LSEG.

The company’s stock closed down 0.76% in Wednesday’s trading session. It fell further in after-hours trading, declining by 3.4% at one point, though that drop was pared back to about 1.9%.

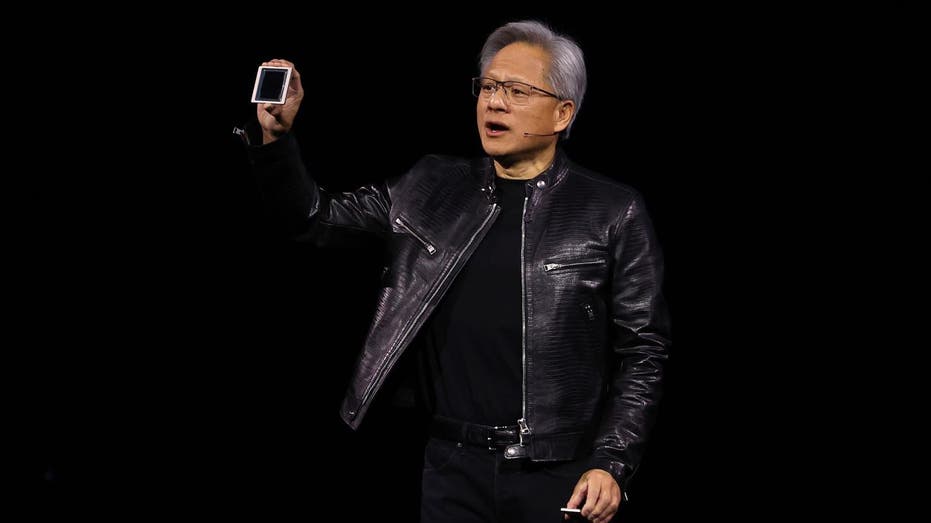

“The age of AI is in full steam, propelling a global shift to Nvidia computing,” said Jensen Huang, founder and CEO of Nvidia. “Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.”

TOP 2024 ETFS TIED TO ONE STOCK: NVIDIA

“AI is transforming every industry, company and country. Enterprises are adopting agentic AI to revolutionize workflows. Industrial robotics investments are surging with breakthroughs in physical AI. And countries have awakened to the importance of developing their national AI and infrastructure,” Huang said.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NVDA | NVIDIA CORP. | 141.95 | -4.72 | -3.22% |

Nvidia’s report showed that in its fiscal third quarter of 2025, revenue was up 17% from the prior quarter and 94% on a year-over-year basis. Operating expenses were up 9% from last quarter and rose by 110% from a year ago.

Net income came in at more than $19.3 billion in the quarter — an increase of 16% from the prior quarter and 109% from this time last year.

HOW NVIDIA BECAME THE KING CHIPMAKER, FROM A DENNY’S TO $2.3T MARKET CAP

Nvidia set company records in the third quarter for quarterly revenue at $35.1 billion, as well as revenue from its crucial data center segment that came in at $30.8 billion.

Nvidia’s data center sales are driven by companies spending on AI chips amid an expansion of data centers aimed at enabling them to handle the complex processing needs of generative AI programs.

The next-generation Blackwell chip was the focus of some concern among investors amid reports a design flaw was causing the advanced chips to overheat, but Nvidia said it has fixed the design flaw and worked with manufacturer TSMC on the remedy.

Nvidia’s stock is up about 202% for 2024 to date and 189% over the past year amid the generative AI boom.

Reuters contributed to this report.

Read the full article here