If you’re considering bankruptcy—or if you’ve already filed—then you’ve probably heard about something called the 341 meeting.

The 341 meeting is an important part of the bankruptcy process because it establishes the facts of the bankruptcy and decides how the debtor will repay creditors.

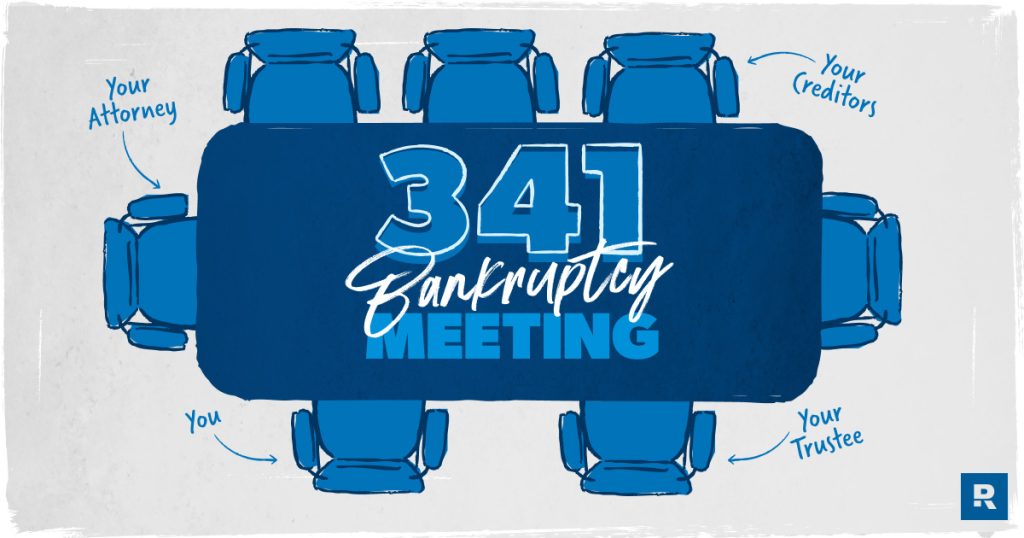

The not-so-fun part? Creditors are also on the invite list. But don’t panic—let’s talk about what exactly goes down during this meeting so you know what to expect.

What Is a 341 Meeting?

A 341 meeting (also known as the meeting of creditors) is a mandatory part of the bankruptcy process where a debtor and the trustee meet to 1) make sure all the facts of a bankruptcy case are accurate and 2) negotiate repayment between the debtor and their creditors. (The name 341 meeting refers to Section 341 of the Bankruptcy Code.)

The 341 meeting happens about 21 to 40 days after you file for bankruptcy.1 The court clerk will give you the exact date, time and location of your meeting when your case is filed.

The 341 meeting usually takes place in a trustee’s office, not a courtroom. But even though a judge isn’t present, you’re still under oath—so tell the truth and don’t hide any important information from the trustee.

Who Attends the 341 Meeting

- Debtor (mandatory)

- Trustee (mandatory)

- Creditors (optional)

- Attorneys (optional)

The debtor and the court-appointed trustee are both required to attend the 341 meeting. If you don’t show up, your bankruptcy case could be dismissed!

If a married couple is filing jointly for bankruptcy, both spouses have to attend. Creditors are invited to the 341 meeting, but they don’t always show up. Attorneys are also allowed to attend, but it’s not mandatory.

What Happens During a 341 Meeting

During a 341 meeting, the trustee goes over the debtor’s paperwork with them to make sure nothing was left out of the bankruptcy case when they filed, including any forgotten debts or assets.

If creditors show up to the meeting, it’s usually to see if the debtor is going to give up an asset (like a car) or if they’re going to reaffirm the debt (recommit to the loan). Just keep in mind that if you reaffirm any debt, you also commit to keep making the payments.

Credit card companies may also join the party to ask about your recent purchases. They mostly want to find out if you ran up your credit card bill on purpose just to get it cleared through bankruptcy. (FYI: That’s called fraud.)

The debtor’s job during this meeting is to let the trustee know if there are any changes that need to be made to their bankruptcy case. It’s also the time to ask questions or file an objection (aka a formal complaint) if a creditor has claimed a debt that’s not true. So, come prepared and don’t be afraid to speak up!

The meeting of creditors is pretty much the same for Chapter 7 and Chapter 13 bankruptcy. However, the focus of the meeting for Chapter 7 is figuring out which of the debtor’s assets to liquidate (or sell) to pay creditors, while the main goal for Chapter 13 is to validate the proposed repayment plan.

Get help with your money questions. Talk to a Financial Coach today!

If the trustee or a creditor doesn’t think a creditor will be paid enough based on the payment plan filed, they could object to the plan—which would mean going before a judge. The trustee could also recommend switching to a different type of bankruptcy if they feel that would be a better option.

What You Need to Bring to the 341 Meeting

For the 341 meeting, you will need:

- Photo ID

- Social Security card

- Bankruptcy documents

- Income verification (such as recent pay stubs)

If the trustee can’t verify your identity, the meeting can’t happen! So be sure to bring your ID and Social Security card. And you can always ask your bankruptcy attorney if you have any questions about exactly what documents you should bring.

How Long Does a 341 Meeting Last?

Every bankruptcy case is different, but the 341 meeting usually lasts less than 10 minutes. And you should only have to do it once. Phew!

What Happens After the 341 Meeting

After the 341 meeting, the debtor still has to complete a debtor education course to move forward with their bankruptcy and have their debts cancelled.

However, creditors have 60 days after the meeting to object to the debt cancellation plan.2 If they object, the court will review the bankruptcy case and decide whether to move forward with the proposed plan or not.

How Long After the 341 Meeting Until My Debts Are Discharged?

For most bankruptcy cases, debts are discharged (cancelled) 60 days after the 341 meeting. But it also depends on the type of bankruptcy filed.3

For a Chapter 7, debts will be cleared as soon as the trustee sells the nonexempt assets (which should have been approved in the 341 meeting) and pays off creditors. This usually takes a couple of months.

In a Chapter 13, the debtor must complete the approved payment plan and make sure all creditors get their money before debts can be erased. This can take about three to five years. But if they fall behind on payments or don’t stick to the plan, the case could be dismissed, putting them back at square one.

Wow, that’s a lot of details for a 10-minute meeting! But it’s important you know what to expect so you can come as prepared as possible. Just remember to be honest with your trustee about your debts. And don’t be afraid to ask questions!

Read the full article here