Key takeaways

- The Apple Card offers 3 percent daily cash back on Apple purchases and select merchants, 2 percent on Apple Pay purchases and 1 percent on all other purchases.

- Manage your Apple Card and the Daily Cash directly from your Apple wallet.

The Apple Card* promises the opportunity to earn cash back on everything you buy, including Apple purchases, without an annual fee. However, the cash back you’ll earn with this card works differently than it does with a traditional cash back credit card.

With the Apple Card, you’ll earn Daily Cash, which accrues each day (as opposed to at the end of a statement period as is typical with rewards cards) and can be redeemed alongside any other funds you have in your Apple Cash account.

Before you sign up for the Apple Card, though, it helps to understand how the rewards program works and the redemption options you may be eligible for to decide for yourself whether it’s worth it.

Apple Card program basics

The Apple Card comes with no annual fee, no foreign transaction fees and no late fees, as well as a tiered rewards program that gives you up to 3 percent back for some purchases. Here’s how the rewards program works:

- 3 percent back on goods or services purchased directly from Apple, including those from Apple online and retail stores, iTunes, Apple Music and other Apple-owned properties.

- 3 percent Daily Cash earned at select merchants, which currently include Duane Reade, Mobil, Panera Bread, Uber, Walgreens, Ace Hardware, Exxon, Nike, T-Mobile and Uber Eats.

- 2 percent back on Apple Pay purchase transactions

- 1 percent back on everything else

The Apple Card, issued by Goldman Sachs, was built to work in conjunction with Apple Pay. However, in instances where you’re shopping with an app or on a website that doesn’t accept Apple Pay, you’ll get a virtual card number that operates in the Wallet app. This card is also a Mastercard, so it’s accepted anywhere Mastercard is accepted around the world.

The Apple Card comes with an average variable interest rate range of 19.24 percent to 29.49 percent, but it can help you pay less in interest by estimating how much you’d pay on a specific purchase and suggesting a payment amount to help you pay down your balance faster. As with most credit cards, you can avoid interest altogether by paying your balance down in full each month.

Apple Card users can also access an exclusive high-yield savings account with Goldman Sachs. Once you set up an Apple Savings account, your Daily Cash rewards will be automatically added to your savings account, which offers a 4.40 percent APY. There are no minimum deposit or balance requirements, and you can withdraw your rewards at any time without paying a fee.

That said, the Apple Card is more limited than other credit cards since the reward redemption options are restricted — the card, after all, is designed for Apple enthusiasts and the rewards are geared toward keeping you that way.

How does the Apple Card’s cash back work?

When you rack up cash back with the Apple Card, you’ll be rewarded in the form of Daily Cash. For the most part, the term “Daily Cash” is only used to describe the amount of cash back you’ve accrued in your rewards account. Unlike other cash back credit cards that award you once per month when your credit card statement closes, Daily Cash accrues every day as you earn it.

As Daily Cash accrues, it will automatically be added to your Apple Cash account or Apple Savings account (if you have one). Apple Cash is a component of Apple Pay that lets you maintain a cash balance you can use toward purchases or sending money to friends, among other options. For instance, when you shop with Apple Pay and have a balance in your Apple Cash account, you can use it to pay for purchases instead of using another form of payment tied to your account.

How to find your Daily Cash

Finding your Daily Cash is simple. Just unlock your iPhone, open the Wallet app, and choose your Apple Card. Then tap on the three dots in the top right corner and choose Daily Cash. That’s where you can see how much Daily Cash you’ve earned, where it’s depositing to and any special offers.

EXPAND

Your Daily Cash doesn’t expire or lose value, so you’ll find it in one of the three places you can choose to leave it —

- In your Goldman Sachs savings account.

- In your Apple Cash, from which you can transfer it to your bank account.

- Accumulating on your Apple Card (if you haven’t set up the other two options).

If you didn’t set up either of those options, the Daily Cash keeps growing and can be redeemed as a statement credit to your Apple Card, which counts as a payment.

Bankrate insight

It’s important to note that if you choose to deposit your Daily Cash to Apple Cash, that balance gets combined with any other Apple Cash you’ve received. For example, if someone sent you $25 Apple Cash to cover their half of lunch and you deposited $1 of Daily Cash, you would see a balance of $26.

How to change the destination of your Daily Cash

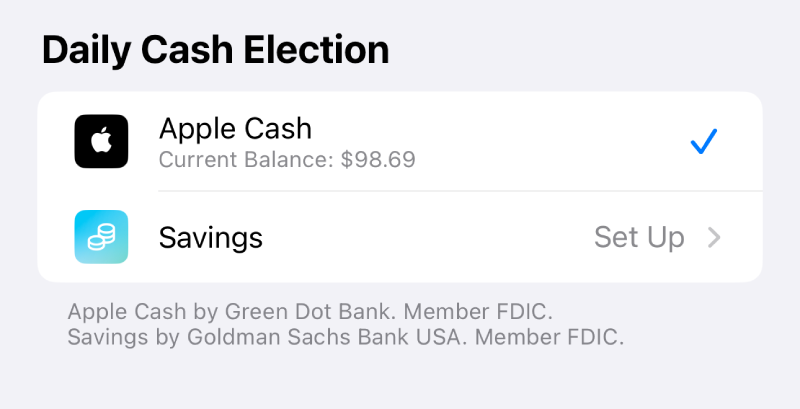

Want to change where your Daily Cash gets sent to? Take the same steps as finding your Daily Cash and look under the Daily Cash Election heading. As long as you have the Savings or Apple Cash set up, you can just tap on which one you’d like to change it to. It typically takes at least one business day for your selection to go into effect. The one you’ve chosen successfully will have a blue checkmark next to it.

EXPAND

If you elect to send it to savings, you’ll earn interest on your balance. However, if it’s set to contribute to your Apple Cash balance, you can use it to make purchases and send money to people you know. Choose which way works best for your purposes and switch it up anytime you want.

What can you redeem Apple Card’s Daily Cash for?

You can use your Daily Cash rewards for:

- Buying items via Apple Pay

- Sending money to friends

- Paying down your credit card balance

- Growing your savings in a high-yield Apple Savings account

When you use your cash back to make purchases through Apple Pay, the options for redeeming your cash back rewards are nearly endless since you can use Apple Pay anywhere it’s accepted — in grocery stores, boutiques, restaurants and more.

EXPAND

You can also use Apple Cash to make purchases in iTunes, Apple Music, the App Store, iCloud and Apple News+.

Pros and cons of Apple Card’s cash back program

While the Apple Card offers some generous benefits and rewards, it’s not for everyone. In fact, you need to be an Apple customer to get the most out of this cash back credit card. To access and use all of Apple Card’s features, you’ll need to add your Apple Card “to an eligible iPhone or iPad that you own with the latest version of iOS or iPadOS,” according to Apple.

To help decide if the Apple Card’s rewards program is right for you, consider these additional pros and cons:

Pros

- Up to 3% rewards rate is higher than the rates many cash back cards offer

- No hidden fees like annual fee, late fees or foreign transaction fees

- Cash back rewards accrue daily in the form of Daily Cash

- Cash back can be automatically deposited into a high-yield savings account that earns 4.40 percent APY

- Free laser-etched titanium card by request

Cons

- Must use Apple Pay for the best rewards rates to apply

- No way to redeem your rewards directly for options like gift cards or travel

- Rewards mix with your Apple Cash balance, which may not be ideal if you’re saving cash back for a specific redemption

- No welcome offer or balance transfer offer

Is Apple Card’s cash back program worth it?

If you’re a devoted Apple customer who makes a lot of purchases with the brand and already uses Apple Pay, then the Apple Card and its rewards program may fit well with how you already spend money. But if you don’t have an Apple device and also don’t plan on getting one, this card and its rewards program will be of little value to you.

At the end of the day, the Apple Card is best for consumers who already operate in the Apple universe and who mostly want to redeem their rewards toward purchases or for statement credits or deposit their rewards in a high-yield savings account.

The bottom line

While the Apple Card can be ideal for Apple enthusiasts, don’t forget to compare it with other options out there. There are still plenty of top rewards credit cards that let you earn a similar rate of rewards in popular bonus categories. Plus, these cards’ rewards structures won’t be tied to your mobile device, and you may have more options for cashing in rewards.

As always, you should compare credit card offers you’re considering in terms of the rewards rates, benefits, welcome offers and fees before you choose a card.

*The information about the Apple Card has been collected independently by Bankrate. The card details have not been reviewed or approved by the card issuer.

Read the full article here