You know that feeling you get when you find $20 in your pocket? Imagine finding $500!

And if you can find that kind of money without cutting the budget, that’s even better, right? So, what’s the trick? It’s quick and easy—all you have to do is take a look at your insurance policies. And while that may not sound like a fun way to spend an afternoon, just think about all the things you could put that money toward . . .

Old Policies Could Cost You

When it comes to insurance, most people like to set it and forget it. In a survey, 55% of drivers report staying with the same insurer for six years or more.[1] In that amount of time, your insurance needs can change. But we keep those old policies, believing our loyalty is earning us a discount. The truth is it’s frequently not—sometimes they even charge you more because they think you don’t care.[2] It’s called “price optimization”—look it up!

Phil H. found this out when he finally took a good look at his home and auto insurance. He and his wife had been using the same insurance company for more than 20 years until he consulted an independent insurance agent for home comparison quotes.

“Our agent helped us save $600 per year on our home and auto insurance,” Phil told us. “That savings will go to our debt snowball—we’re almost there!”

Phil isn’t the only one. Another survey shows 39% of respondents switched home insurance carriers because they could save money.[3]

What You Need: Nothing More, Nothing Less

You don’t have to do all this alone though. Remember what Phil said? His agent found him a better deal. Phil’s agent was able to do that because independent agents aren’t tied to one insurance company. They shop and compare policies from several companies to find the right coverage at the best price. And then you get to pick. Is that your budget and your calendar shouting for joy?

One of the ways an independent insurance agent can save you money is by making sure you have all the coverage you need—and none you don’t. They’ll look at your situation and help you know when a policy offers enough protection, and when you need a little more.

There are eight types of insurance pretty much everyone will need at one point or other:

- Auto insurance: If you own and drive a car, you need this insurance.

- Health insurance: If you’re alive, it’s best you stay that way with health insurance.

- Life insurance: Do you have any dependents? If anyone lives off your income, you need life insurance. (We recommend term life.)

- Homeowners or renters insurance: Houses and the stuff inside get destroyed every day. If you own a house, you need insurance to protect your biggest investment. If you rent, you need insurance to cover your stuff—because the landlord isn’t going to.

- Long-term disability insurance: Anyone can become disabled. You don’t have to work a dangerous job—a car accident could do it. You need this.

- Long-term care insurance: If you’re over 60, it’s time to get this.

- Identity theft protection: Getting your identity stolen could wipe you out financially, and there are too many ways you’re vulnerable to it. Everyone needs this protection.

- Umbrella insurance: If your net worth is over $500,000, you need this. It protects you from people looking for a big lawsuit payout and more.

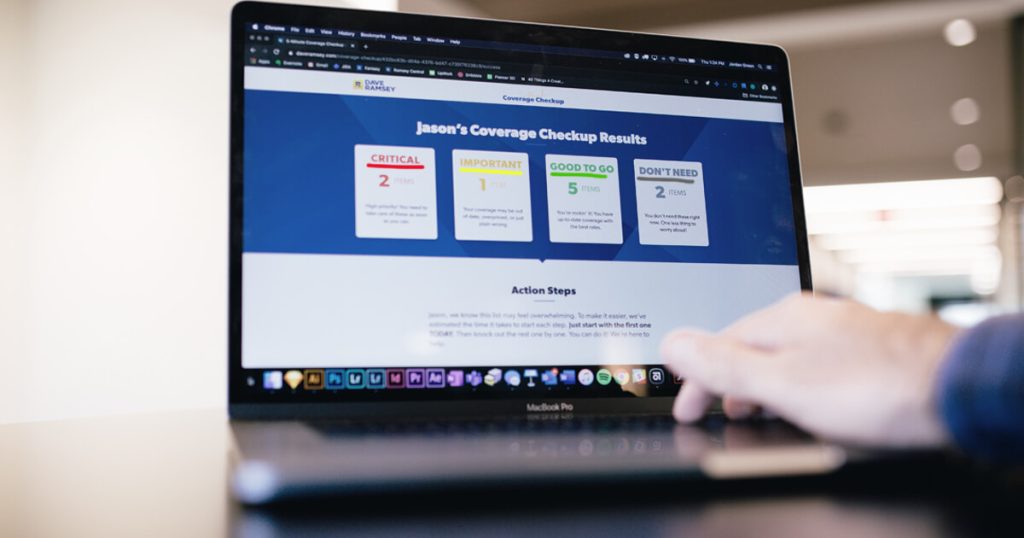

And if you’re not sure what you should keep, what to increase, and what to drop in coverage, take our 5-Minute Coverage Checkup to make sure you have what you need.

Big Names Could Mean Big Bucks

The biggest companies in the insurance industry pour billions of dollars into advertising to build that name recognition among potential customers.4 That’s how big companies convince many insurance customers that they offer lower prices and more convenience.

Do you have the right insurance coverage? You could be saving hundreds! Connect with an insurance pro today!

But buying insurance directly from the big guys isn’t always in your best interest. In fact, going through a RamseyTrusted pro like Michael H. can net you a great deal.

“I saved 43% on my homeowner’s policy and 38% on my auto insurance,” he told us. “And both policies provided better coverage.”

Michael and his family will save $700 a year on their coverage, and all it took was one phone call.

More Than the Bottom Line

An independent insurance agent does even more than help you save money. Your insurance agent can also:

- Clearly explain your coverage

- Make sure you are fully covered

- Help you get claims paid quickly and fairly

- Represent your interests

If you want to save money like Phil and Michael, get in touch with a RamseyTrusted insurance pro. They’re independent insurance agents who have earned our seal of trust for excellent service. They’ll do all the heavy lifting for you. With our insurance pros, you can save money and have peace of mind about your coverage. So get shopping, people! It’s the kind your budget will thank you for.

Read the full article here