Transferring funds from a pre-tax retirement account such as an IRA to an after-tax Roth IRA is a move many retirement savers might want to consider. A Roth conversion, as the move is called, has many benefits. It can help you avoid required minimum distributions, or RMDs, in retirement, as well as taxes on your retirement withdrawals. There are even some estate planning benefits. Gradually converting IRA funds to Roth funds is a popular refinement of the technique, because it can save on taxes now while providing for tax-free withdrawals later on. However, converting 20% of your IRA to a Roth account every year may or may not represent an optimal approach. And in some cases, it may be more efficient not to convert at all. A financial advisor can help you identify a promising strategy for funding your retirement, but here are some things to consider.

Roth Conversion Rules

Roth conversions offer a lot of appeal to retirement planners. Roth accounts are not subject to Required Minimum Distribution (RMD) rules, so retirees won’t have to make mandatory withdrawals that could increase their tax liability after they stop working. Also, Roth withdrawals incur no income taxes past age 59 1/2, so they don’t affect Social Security benefit taxation, among other benefits. Roth accounts also can provide for tax-deferred transfers of wealth to heirs, making them popular in estate planning.

For many savers, the chief concern is whether the retirement saver will be in a higher income tax bracket after retiring. If they will be in a lower tax bracket, the Roth may not make sense. That’s because any funds converted from a pre-tax retirement account such as an IRA are taxed as ordinary income when the conversion occurs. With that in mind, if a saver expects to be in a lower income tax bracket post-retirement, as is often the case, it won’t save money to pay taxes now at a higher rate. A financial advisor can help you devise an appropriate tax strategy for your Roth conversion.

Roth Conversion Techniques

Because funds transferred from an IRA into a Roth are treated as taxable income when the conversion occurs, it can get very expensive to convert a large IRA all at once. Gradual conversion is one popular approach. Spreading the conversion out over multiple years can avoid bumping the taxpayer into a higher bracket, reducing the current and overall tax burden.

When designing a Roth conversion plan, aiming to convert a percentage each year also may not be the best approach. That’s because the dollar amount of the conversion, not the percentage, is what affects current taxes. The usual approach is to convert only enough IRA funds every year to move the taxpayer’s income up to the top of the current bracket.

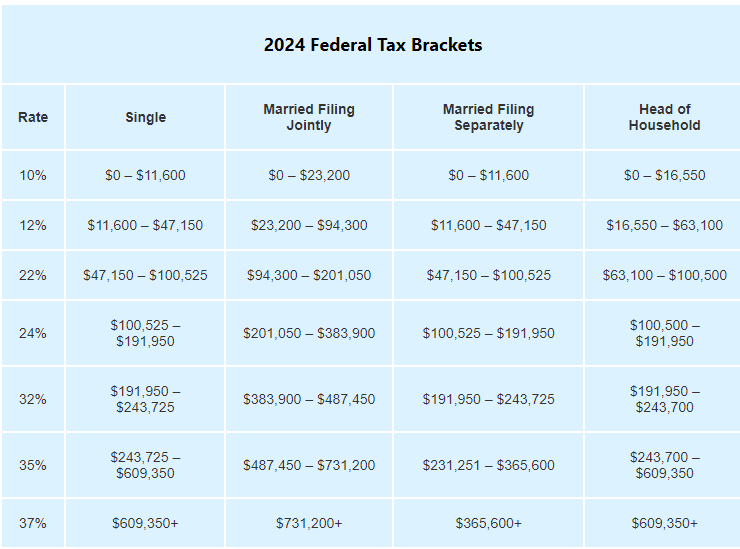

The amount converted in a tax year will be added to your other income, such as wages and self-employment income, to ultimately determine your adjusted gross income (AGI). Your AGI will determine your tax bracket. For example, according to 2024 marginal tax rates, if you made $150,000 in salary with no other income, you could convert up to $41,950 (the upper threshold of the 24% bracket, $191,950, minus $150,000 salary) this year before being bumped into the 32% tax bracket.

That way, while the tax bill goes up, the rate of taxes won’t increase. Over the years it may takes to convert a sizable IRA, this can save significantly on the total tax bill. Consider matching with a financial advisor who can help you plan and execute a Roth conversion strategy.

Other Conversion Considerations

It also is likely a good idea to approach a Roth conversion with some elasticity. That is, rather than planning on converting a set amount every year, be ready to adjust the amount based on your current situation. For example, if one year your income is lower than in a typical year, you may be able to convert a larger amount of IRA funds that year without bumping you into the next tax bracket.

Also be aware that, because Roth conversions are treated as ordinary income, this strategy can impact many other aspects of your financial life. Those include taxes on Social Security benefits, what you’ll pay for Medicare Part B coverage, Affordable Care Act health insurance subsidies and more. Also keep in mind that once you open a Roth account and convert money to it, you will have to wait five years before withdrawing the money penalty-free. This means individuals close to retirement who will need the money right away may need to reconsider. Developing a comprehensive plan for Roth conversion calls for comparing the likely outcomes of multiple scenarios to see which one offers the most advantage.

Bottom Line

Converting IRA funds to a Roth account makes sense for some retirement planners because of the way it avoids RMDs and provides for tax-free withdrawals. And gradually converting a portion of the IRA each year can save on current and future taxes. However, conversion may not be right for everyone, so a comprehensive consideration is in order.

Tips

- Devising an optimal Roth conversion strategy generally calls for running multiple what-if scenarios that take into consideration a wide array of tax concerns. A financial advisor can help you do just that. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

- Use SmartAsset’s RMD Calculator to project the future amount of your mandatory retirement account withdrawals.

- Keep an emergency fund on hand in case you run into unexpected expenses. An emergency fund should be liquid — in an account that isn’t at risk of significant fluctuation like the stock market. The tradeoff is that the value of liquid cash can be eroded by inflation. But a high-interest account allows you to earn compound interest. Compare savings accounts from these banks.

Photo credit: ©iStock.com/elenaleonova

Read the full article here